“There are two kinds of people; those who borrow money and those who lend it.”

Private lending is one of the oldest, most proven forms of investing; lending capital to another—perhaps someone who can’t get traditional bank financing—in exchange for interest.

A private lender lends money to helps borrowers:

- purchase real estate (for a mortgage or a short-term bridge loan until permanent financing is put into place.)

- rehab or improve commercial or residential real estate (again, often with a bridge loan)

- start or expand business ventures

- refinance credit cards or other debt

- or fund a host of other projects—from kitchen remodels to weddings

In recent decades, investing has become equated almost exclusively with stocks, bonds, and mutual funds. However, with the volatility in the stock market, it makes sense to diversify at least a portion of your portfolio with private lending strategies. Here are seven reasons to consider private lending:

1. Historically proven.

Private lending has been a reliable way of generating profits and cash flow for literally centuries. There is documentation of private lending agreements as early as 3,000 B.C., showing people loaning to others for defined periods of time in exchange for “interest” paid in wheat, livestock, shekels of silver, or other commodities. Interest rates of 20% – 40% were common in ancient times, though extraordinarily high rates became known as “usury” and became discouraged or outlawed.

Investors have learned that what goes up may go down… way down. After severe losses, many swear off the stock market and instead lend money to those who need capital. Profits are steady and reliable, and it eliminates the risk of market crashes.

2. Predictable returns.

When you invest in the stock market, you are placing a bet that the price will go up. Yet we know, historically, many times things have gone horribly wrong, and fortunes have been lost.

When you loan money as a private lender, you have an agreement that specifies how much you’ll be paid and when. Properly constructed with protections and the right borrower, this delivers very predictable returns.

The exception? If your private lending deal is not constructed correctly or vetted, there is a chance of loss. That does not necessarily mean that you’ll lose your capital, but in cases where the borrower was paying you directly, a property could be foreclosed on and must be sold for you to be repaid.

3. Excellent cash flow.

In addition to passing the test of time, banks and other institutions that operate as lenders are some of the most profitable businesses in the world. Unfortunately, many people tend to be borrowers, not lenders! If you’ve got money to lend, congratulations, you can put it to good use.

In this low-interest environment, you can earn several times what your bank is paying without the unpredictability of the stock market. And if interest rates at banks go up, so do interest rates for private lenders. There will always be people who need to borrow money outside of mainstream channels.

Today, investors who want more income from their existing assets can earn high single-digit or low double-digit interest rates by becoming private lenders. In many cases, the monthly payment is contractually agreed upon, so you know exactly what cash flow you can expect.

4. Diversification.

Not only does private lending help diversify a stock-heavy portfolio, but you can also diversify among different real estate investments such as a real estate bridge loan, a fractional investment in real estate (apartment building) equity, or a collection of peer lending loans.

5. A secured investment.

If you are lending on real estate, your investment will likely be secured by the property itself, perhaps with a first deed of trust, although there are several different ways that private lending deals can be structured. Just make sure you’re not last in a long line to be paid!

Whether you are lending directly or through a company that vets the deals, you’ll want an appraiser to verify that the property is worth substantially more than the amount you are lending. The lower the loan-to-value percentage, the more security you have for your investment.

In a worst-case scenario that requires a foreclosure, you could actually reap additional profit. Alternatively, many private lenders prefer to work with companies that manage the transaction and pay them directly, to reduce their risk.

Of course, not all private lending opportunities are secured by a real asset. In the case of peer lending, the borrower’s income and good credit may be your “security.” Peer lending returns are tiered so that lower-risk loans (with high-credit score borrowers) pay less interest, while higher-risk loans pay more interest yet also have higher default rates.

6. Leveraged investment opportunities.

It’s called arbitrage: By investing money you have borrowed at a lower rate to earn a higher rate, you can earn an exceptional rate of return and expand your investments. A couple of examples:

Let’s say you have a daughter who is getting settle in her first home. She purchased some furniture, window coverings, and appliances from various stores on credit. Now she’s got $6000 of debt at rates of about 21%!

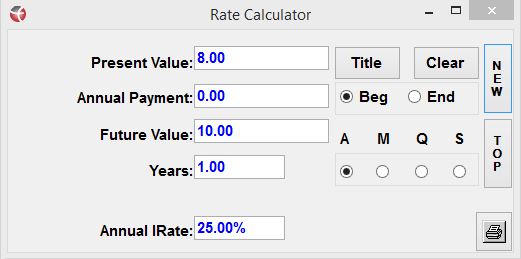

You hate to see her paying 21%. You borrow $6000 against your life insurance policy at 8% to take care of the debt, and they happily agree to pay you back at 10% interest. You are actually earning 25% on the money that you are borrowing, and she is saving interest big-time:

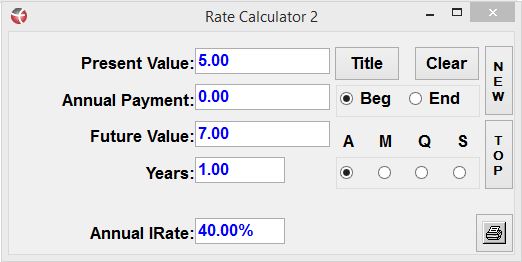

That’s a small, simple example. Let’s look at a large, lucrative one. You leverage your whole life cash value as collateral and borrow $50k from a bank at 5%. Then you put the money into a bridge loan earning 7%. Your rate of return is actually 40% on the money:

To understand this concept of arbitrage more thoroughly, watch this financial calculator video from Truth Concepts financial software developer Todd Langford, as he explains “How Banks Make Money.” (It’s not how most people think!)

7. You look like a genius.

When—or if—you tell your friends you are going to be a private lender, chances are, they’ll be concerned for you. They’ll tell you it’s risky (and it can be if you do it yourself!) People may share horror stories or even try to talk you out of it.

But when you’re an experienced private lender, and you tell your friends that you’ve been collecting healthy cash flow for years, with none of the losses or stress of the stock market, they will want to know how they can do it too!

Would you like to turn an existing asset into steady, reliable cash flow? Become a private lender and use the investment strategy with the longest track record in history! Contact us at hello@neeserinsurance.com, Tom@neeserinsurance.com, or give us a call at 574-234-1980. We will get you more detailed information and help you identify which options might work best for you.

We appreciate our loyal clients and hope that you will help us continue growing by referring your friends, family, and co-workers. Please share our blog, website, and contact information with those that you think we could help!